In this article, you will find the best way to plan medical and funeral expenses! After reading this article , you will be able to find the answers to these questions.

Table of Content :

- Why is final expense insurance the right choice for you?

- How can you plan to manage end-of-life expenses such as medical expenses and funeral expenses?

Be proactive and be prepared for illness, old age, and death in advance. Final Expense Insurance is your right choice because it can meet all you funeral expenses to a considerable extent.

Read our guide, and it will help you pay for funeral expenses.

The total cost of burial expenses and final expenses insurance.

Suppose you do not want your loved ones to bear medical and funeral expenses. Read this article to learn more about how to keep your loved ones peaceful, don’t let your funeral expenses cover them, and don’t let them get into trouble because of the substantial financial burden. This is the best way to plan your medical and funeral expenses: Final Expense Insurance is the best choice for you.

Planning how your money should be managed in the event of illness or death is essential.

Good planning will help ensure that you or your family is prepared for the costs that may arise. It will also allow you to provide for your loved ones and ease the burden on them

The Senior Care Plan, we are proud of our history of building long-term relationships with our customers. The only way we can do this is to do business with our customers most honestly and transparently.

The Senior Care Plan Insurance Agency is not restricted by specific companies nor has special contracts.

Another important thing you need to know is that The Senior Care Plan Insurance Agency works with more than 30 top operators in the industry with A-level standards. We have a quotation engine, and we operate according to the results it produces. After customers choose an insurance policy, we will respect their choice unless we are asked our opinion or see another specific company offering something that may interest customers’ additional benefits.

Final Expense Insurance is the best way to ensure that your family will not have to use their savings to pay for funeral and medical expenses that may be left behind.

Despite saving and preparing for retirement throughout their working lives, many retirees are mentally or financially unprepared for the high cost of medical expenses in retirement. Whether you’re early in your career, nearing retirement, or already transitioning out of the workforce, it’s essential to understand and plan for rising medical costs.

Being a caregiver for an aging or a health condition, whether physically, financially, or both, is a compassionate choice that involves immediate and long-term financial planning. It is essential to understand all the expenses involved and what you can afford.

Health care can be one of the most significant expenses a person faces in retirement. A 65-year-old couple who retired in 2020 can expect to spend $ 275,000 on health care and medical expenses during retirement.

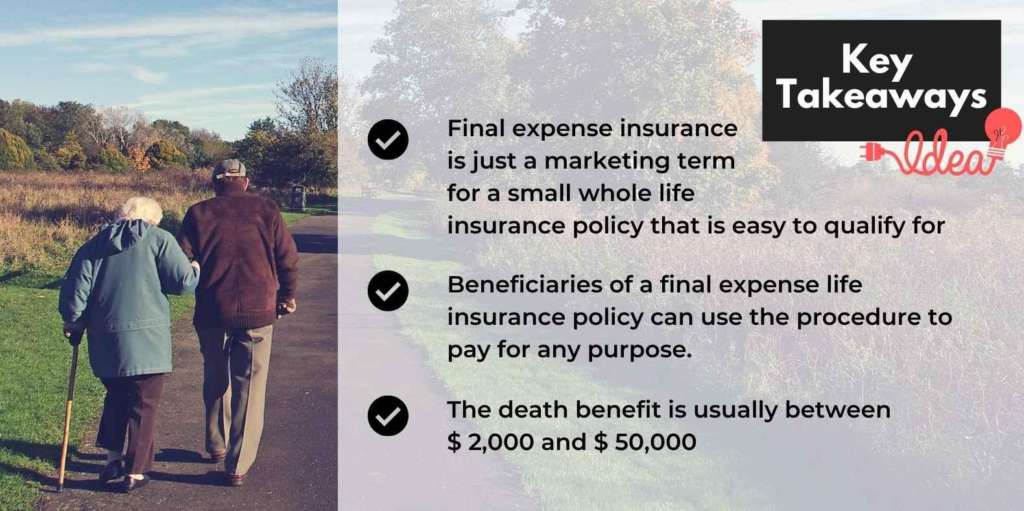

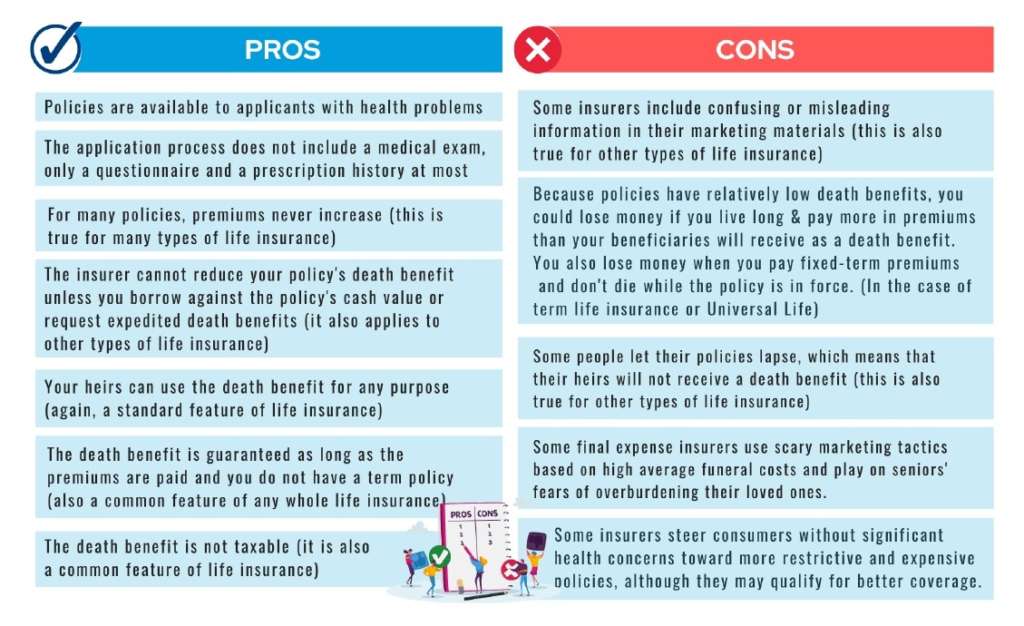

Whole life insurance promises a death benefit anytime you die, as long as you are up to date with your premium payments. However, although final expense insurance is marketed for burial expenses, your beneficiaries can use the benefit for any financial need they may have, including paying medical debt accumulated during their final illness or any other financial obligation.

What Is Final Expense Insurance?

Final expense insurance is a life insurance policy with a small death benefit and is easier to approve. Final expense insurance is also called.

- Funeral insurance

- Burial insurance

- Simplified issue whole life Insurance

- Modified whole life Insurance

Final expense insurance is a permanent whole life insurance policy designed to cover the cost of your funeral and other end-of-life expenses, such as medical bills, legal fees, housing costs, and any other remaining bills. Burial insurance and funeral insurance are other commonly used terms for final expense insurance.

Final expense life insurance is a type of permanent life insurance where the death benefit is used to cover medical costs and other end-of-life expenses, most often funeral costs including services like burial or cremation, items like caskets and urns, and more. Permanent life insurance does not expire and remains in force for as long as the premiums are paid.

If you purchase final expense insurance, as long as you continue to pay the premiums, the policy will affect you until you die. Your beneficiaries will receive the death benefit. Unlike traditional life insurance policies, which require a medical exam to help set the cost of your policy, final expense policies like a burial insurance policy don’t need such in-depth research, and applicants will often be insured after answering only a few questions.

A final expense life insurance policy isn’t the same as what’s known as “insuring your life.” Insuring your life concerns leaving your family and loved ones with enough support after you pass away.

Term and permanent life insurance value your policy as proportionate to your earning power now and for the rest of your life. With funeral insurance, although a permanent policy, the value of your policy is proportional to the expense of your desired funeral (keeping inflation in mind). While other forms of life insurance can top a million dollars, it’s rare for final expense insurance policies to get above $20,000.

WHAT’S GOOD ABOUT FINAL EXPENSE INSURANCE?

Final expense insurance is relatively affordable if you’re on a tight budget. It typically doesn’t provide as much coverage as other insurance (more on that later). Still, if you only need enough of a payout to cover burial costs rather than a payout for long-term expenses, it could be enough for your needs.

Final expense insurance provides peace of mind in regards to funeral expenses being covered. With a traditional insurance policy, your dependents are using that death benefit for every payment: mortgage, college, everyday living, and so on, in addition to funeral costs. With final expense insurance, you and your beneficiaries know what the money is supposed to be used for, taking much of the stress out of planning your burial.

You’re looking for affordable coverage.

HOW TO USE FINAL EXPENSE INSURANCE AS FUNERAL INSURANCE

Some policyholders of final expense insurance; typically skew older and may not have trusted people like a spouse or siblings to name as their beneficiary. Some funeral homes will accept an assignment of the insurance policy death benefit payout. This means that the proceeds will go directly to the funeral home to cover the funeral cost. (The funeral home would be the primary beneficiary, with the secondary beneficiary receiving any money left over after the funeral cost.) When you’re making arrangements, make sure to ask about this and don’t assume that the funeral home will accept this sort of payment method; some funeral homes require payment upfront and won’t wait until the final expense insurance policy pays out.

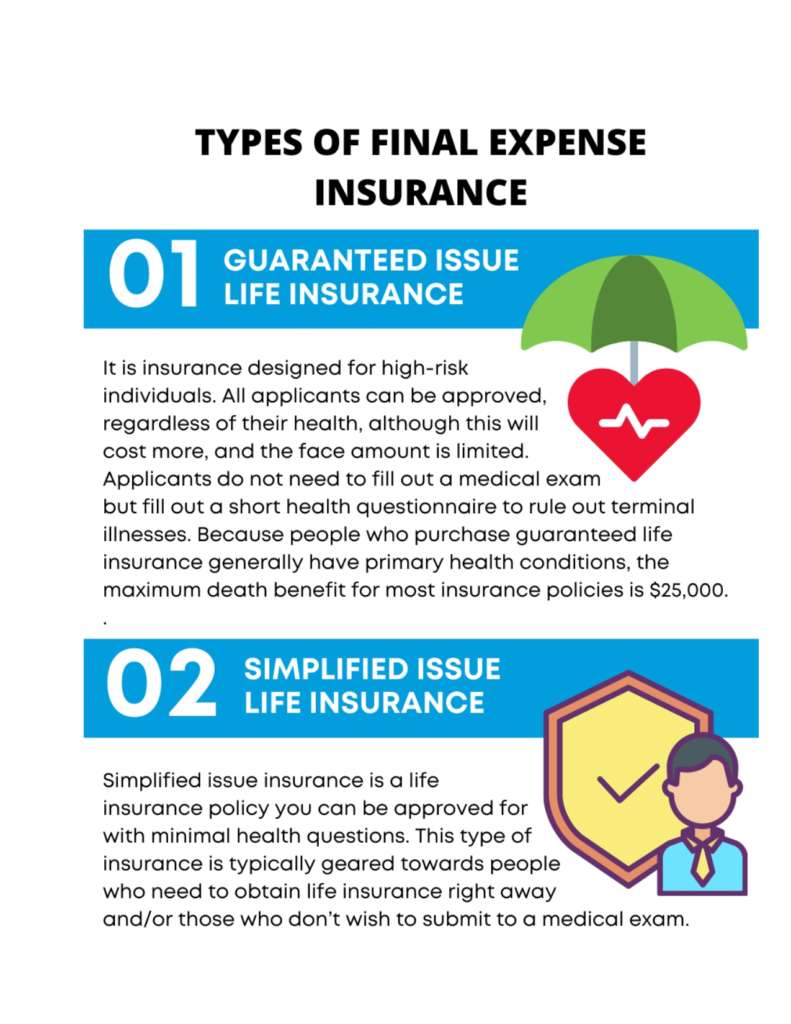

Guaranteed Issuance of life insurance or guaranteed acceptance of life insurance is a whole life insurance policy that does not require you to answer health questions, undergo a physical examination, or allow the insurance company to view your medical records and prescription records.

Sounds great, right?

This is the place to grab. There is always a waiting period to guarantee the Issuance of life insurance. If you die during the waiting period, your beneficiary will not receive the policy’s death benefit. For most policies, the waiting period is two years. And some are three.

This is not some scam. If you die during the waiting period, the insurance company will repay all insurance premiums plus interest to your beneficiaries, usually 10%.

Your beneficiaries will still get some benefits; it will only be less than you want. The insurance company has set this waiting period because everyone can apply for insurance before they die and pay a few hundred dollars to win $25,000 for their family. No insurance company can continue to operate in this way. Guaranteed life insurance provides insurance for otherwise unavailable patients.

Simplified issue life insurance is designed to provide a limited amount of life insurance quickly, without the 4-8 week wait typical for conventionally underwritten policies that require a medical exam.

Simplified Issue policy, there’s no requirement for a complete medical exam so that you can have coverage in days – not weeks or months. The death benefit payout can range from $5,000 to more than $100,000. The premiums may be higher than a typical term life or even a whole life policy. Preceding a medical exam means underlying health issues can’t be factored in. Since risk is considered higher, the premium will be higher as well.

When to buy a simplified issue policy?

Suppose you need life insurance but don’t want to have a medical exam or require life insurance as quickly as possible without a waiting period. In that case, a simplified issue life insurance policy may be the solution. Here are some circumstances when a streamlined issue policy could be a good choice:

You’ve been court-mandated to get life insurance immediately with your children named as Beneficiaries It would help if you had collateral for a loan – in some cases, a financial institution will accept a life insurance policy as collateral.

Your term life insurance has matured, and you need to retain life insurance while you decide what to do next.

It would help if you had life insurance, but you aren’t sure you’d qualify for more traditional policy types.

It would help if you had life insurance, but you don’t want to undergo a medical examination. Advantages of simplified issue life insurance

Note:

You do not have a comfortable nest of eggs and are concerned about the financial burden you will place on your spouse and children when youdie.

Who Needs Burial Insurance?

Final expense insurance is best for candidates who are generally not eligible for traditional life insurance coverage. This includes:

¬ People over a certain age

¬ People suffering from a severe illness

¬ People who have low (or no) income and have no assets

Health conditions that make final expense insurance a more suitable coverage option include cancer, HIV, or Parkinson’s disease. For most others, traditional life insurance options are more profitable.

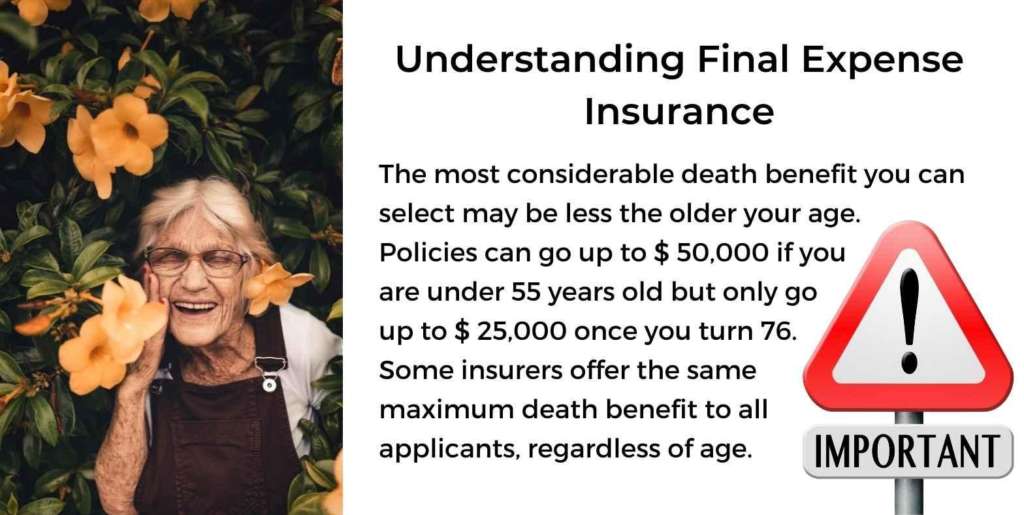

Smaller death benefits: The lower death benefit of final expense insurance makes premiums more beneficial. It may not cover everything, like paying off a significant mortgage. No matter when you die, his heirs will get the death benefit you want them to have, as long as he has paid his dividends.

-

Read our piece {Types of Final Expense Insurance}

final expense insurance will help your loved ones pay the bills – bills directly related to your death, bills they will have a more challenging time paying without your income, or anything else.

Understanding Final Expense Insurance premium

As mentioned earlier, final expense insurance is a type of whole life insurance. Entire life policies are pretty easy to understand when it comes to permanent life insurance. Once you have your policy, your premiums can’t go up, and your death benefit can’t go down. Unlike a term policy, a lifetime policy does not expire when you reach a certain age. A lifetime policy also builds up a cash value that you can borrow against. However, any loan that is not repaid when you die will reduce the amount of money your beneficiaries receive. When you apply for final expense insurance, you won’t have to deal with a medical exam or allow the insurance company to access your medical records. However, you will need to answer a few health questions. Due to health concerns, not everyone will qualify for a policy with coverage that begins on the first day.

Conclusion:

Final expense insurance is an affordable option to pay for funeral expenses. Final Expense insurance is best for seniors who want to spend the rest of their lives knowing that their final cost will be protected; their loved ones don’t have to worry about paying funeral expenses. Whole life insurance promises to provide death compensation when you die, as long as you pay the premium in time. However, although final expense insurance is sold for funeral expenses, your beneficiaries can use the benefit to meet any financial needs they may have, including paying medical debts or any other financial obligations they accumulate during the final illness.

faq

Final Expense Life Insurance FAQs:

Final expense policies are a type of permanent life insurance with a lower death benefit intended to pay for expenses at the end of life. There are two types: guaranteed issue and simplified issue.

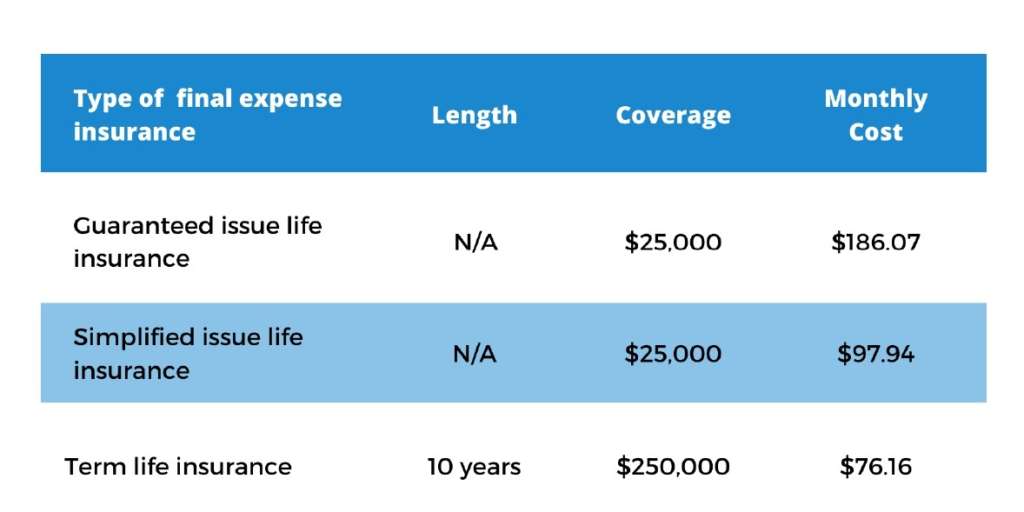

Premiums vary by age and provider, but you’ll pay more for final expense insurance than a standard term policy. Final expense policies are whole life. This means that for as long as the policy is enforced, the likelihood of the carrier paying the claim is very likely as opposed to a term life insurance there’s a high likelihood that the insured will outlive the term of the policy, and this is the reason there’s a difference in cost between the two policies.

Final expense insurance is best for

- Older applicants with serious health problems. The payment can be used for final medical and funeral expenses.

- Young individuals who would like to secure their rate at a young age and design the policy with a payout of 10 years and be done with their payments