Nowadays 91% of families lose everything in the first 12 months after their sustenance’s death. Such as houses, cars, education for kids, their entire lifestyle is forced to change. Final expense insurance is one of the most difficult things to talk about. Yet, it’s necessary to keep in mind that final expense can be a major burden to your family and loved ones and compound an already difficult moment.

Being prepared with a final expense insurance is one of the best ways to be certain your family won’t be going through any struggles and dip into their own pocket to cover the funeral cost and any debts you may leave behind.

As we well know, as time goes by, prices increase and final expense is not immune to rising its cost. According to The National Funeral Directors Association, the average cost of a funeral has increased more than tenfold since 1960. A funeral in 1986 had a cost between $3,000 and $5,000 and nowadays it has a cost of approximately $12,500. This is something to be afraid of, isn’t it? The worse thing is that prices will continue to increase.

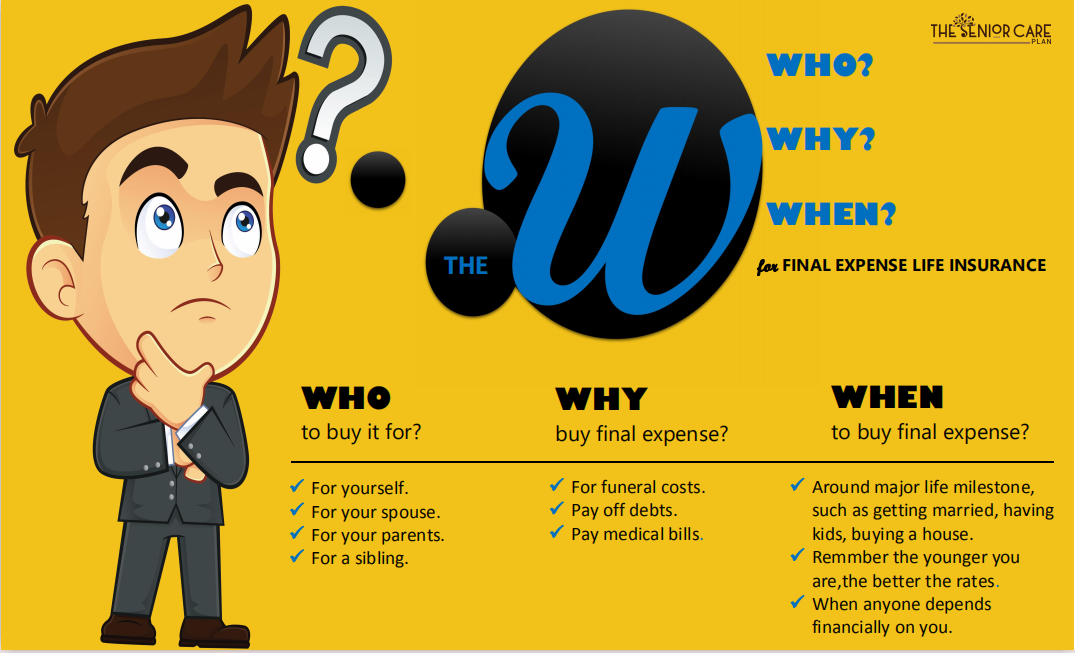

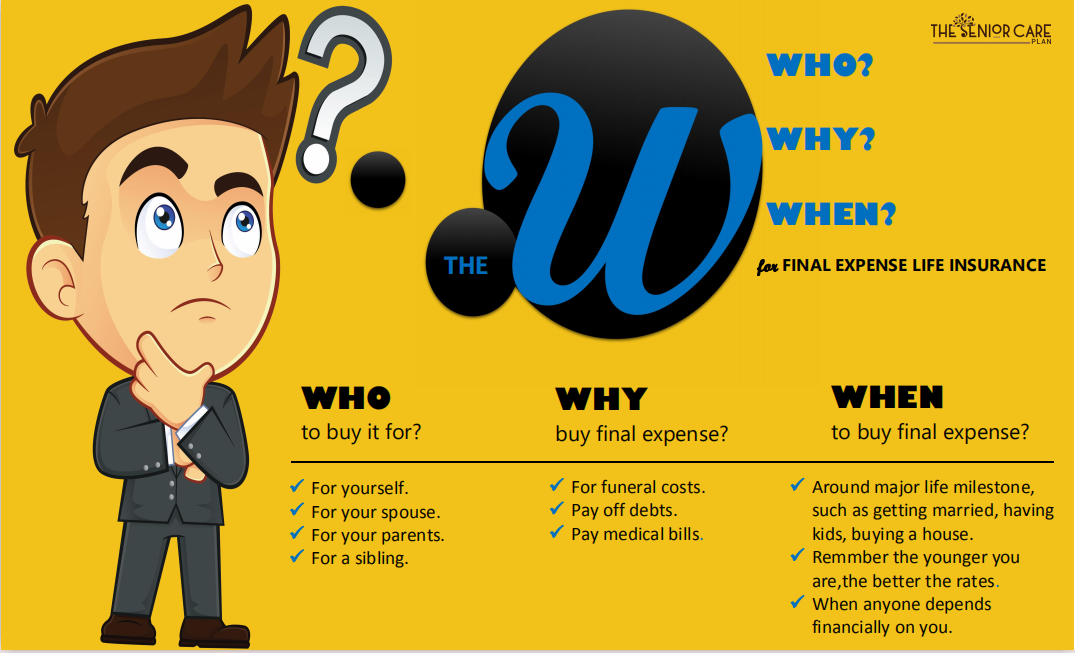

Anyone can enjoy the benefits a final expense policy offers. But for now, let’s look at the criteria for individuals who might find this type of insurance beneficial based on their needs, ease of insurability, and cost.

You May Want To Consider Final Expense Insurance If:

YOUR FAMILY IS GROWN.

Later, as time goes by your family isn’t as likely to be as dependent on your income. And you may not have as much insurance as you did when you had a smaller family or were paying your mortgage. When the day of your passing arrives, what your family may need is available cash. Specifically, to cover all funeral expenses, estate taxes, or immediate expenses that need to be covered by final expense life insurance.

You Have Pre-Existing Health Conditions.

There are many carriers that are willing to give final expense coverage without requiring you to complete a medical exam. Final expense can be easy to qualify for and simple to understand and will never terminate as long as the premiums are always paid on time.

You’re Looking For Affordable Final Expense Coverage.

Final expense premiums tend to be more affordable for those on a fixed budget.

This is what makes it an attractive option for covering end-of-life expenses. It’s a kind of permanent insurance. And, it doesn’t expire if premiums are paid – and it accumulates a cash value over time.

Anyone concerned about leaving their loved ones unprepared when they pass should consider taking out a final expense life insurance policy on themselves. Children can also buy life insurance for parents. Getting multiple quotes can help you determine what type of coverage is best for you.

If you’re independently wealthy or have enough set aside in savings, you may not need final expense insurance. Just keep an eye on rising funeral costs and always make sure you stay up-to-date on current costs.

If you’re over the age of 85, in hospice care, or currently hospitalized you may not be able to qualify. Certain health conditions such as terminal illness or AIDS may also prevent you from qualifying.

Final Expense For Seniors.

As you get older, final expense policies become more difficult to obtain. Not only does your actual age make it more difficult, but older individuals are also more likely to suffer medical conditions that then pose barriers to coverage. While final expense insurance generally does have a medical questionnaire, you don’t have to worry about a medical exam.

Because this type of insurance policy is easier to get the price per benefit amount will be higher. That’s why most policies are generally much smaller. You can get a more substantial policy benefit amount, but when you are in your senior years, it will cost significantly more.

You’re Looking For Affordable Final Expense Coverage.

Final expense premiums tend to be more affordable for those on a fixed budget.

This is what makes it an attractive option for covering end-of-life expenses. It’s a kind of permanent insurance. And, it doesn’t expire if premiums are paid – and it accumulates a cash value over time.

Anyone concerned about leaving their loved ones unprepared when they pass should consider taking out a final expense life insurance policy on themselves. Children can also buy life insurance for parents. Getting multiple quotes can help you determine what type of coverage is best for you.

If you’re independently wealthy or have enough set aside in savings, you may not need final expense insurance. Just keep an eye on rising funeral costs and always make sure you stay up-to-date on current costs.

If you’re over the age of 85, in hospice care, or currently hospitalized you may not be able to qualify. Certain health conditions such as terminal illness or AIDS may also prevent you from qualifying.

Final Expense For Seniors.

As you get older, final expense policies become more difficult to obtain. Not only does your actual age make it more difficult, but older individuals are also more likely to suffer medical conditions that then pose barriers to coverage. While final expense insurance generally does have a medical questionnaire, you don’t have to worry about a medical exam.

Because this type of insurance policy is easier to get the price per benefit amount will be higher. That’s why most policies are generally much smaller. You can get a more substantial policy benefit amount, but when you are in your senior years, it will cost significantly more.

References:

Protective

Ihlic

https://finalexpenseinsurance.com/why-final-expense-insurance-is-perfect-for-seniors/

References:

Protective

Ihlic

https://finalexpenseinsurance.com/why-final-expense-insurance-is-perfect-for-seniors/

You’re Looking For Affordable Final Expense Coverage.

Final expense premiums tend to be more affordable for those on a fixed budget.

This is what makes it an attractive option for covering end-of-life expenses. It’s a kind of permanent insurance. And, it doesn’t expire if premiums are paid – and it accumulates a cash value over time.

Anyone concerned about leaving their loved ones unprepared when they pass should consider taking out a final expense life insurance policy on themselves. Children can also buy life insurance for parents. Getting multiple quotes can help you determine what type of coverage is best for you.

If you’re independently wealthy or have enough set aside in savings, you may not need final expense insurance. Just keep an eye on rising funeral costs and always make sure you stay up-to-date on current costs.

If you’re over the age of 85, in hospice care, or currently hospitalized you may not be able to qualify. Certain health conditions such as terminal illness or AIDS may also prevent you from qualifying.

Final Expense For Seniors.

As you get older, final expense policies become more difficult to obtain. Not only does your actual age make it more difficult, but older individuals are also more likely to suffer medical conditions that then pose barriers to coverage. While final expense insurance generally does have a medical questionnaire, you don’t have to worry about a medical exam.

Because this type of insurance policy is easier to get the price per benefit amount will be higher. That’s why most policies are generally much smaller. You can get a more substantial policy benefit amount, but when you are in your senior years, it will cost significantly more.

You’re Looking For Affordable Final Expense Coverage.

Final expense premiums tend to be more affordable for those on a fixed budget.

This is what makes it an attractive option for covering end-of-life expenses. It’s a kind of permanent insurance. And, it doesn’t expire if premiums are paid – and it accumulates a cash value over time.

Anyone concerned about leaving their loved ones unprepared when they pass should consider taking out a final expense life insurance policy on themselves. Children can also buy life insurance for parents. Getting multiple quotes can help you determine what type of coverage is best for you.

If you’re independently wealthy or have enough set aside in savings, you may not need final expense insurance. Just keep an eye on rising funeral costs and always make sure you stay up-to-date on current costs.

If you’re over the age of 85, in hospice care, or currently hospitalized you may not be able to qualify. Certain health conditions such as terminal illness or AIDS may also prevent you from qualifying.

Final Expense For Seniors.

As you get older, final expense policies become more difficult to obtain. Not only does your actual age make it more difficult, but older individuals are also more likely to suffer medical conditions that then pose barriers to coverage. While final expense insurance generally does have a medical questionnaire, you don’t have to worry about a medical exam.

Because this type of insurance policy is easier to get the price per benefit amount will be higher. That’s why most policies are generally much smaller. You can get a more substantial policy benefit amount, but when you are in your senior years, it will cost significantly more.

References:

Protective

Ihlic

https://finalexpenseinsurance.com/why-final-expense-insurance-is-perfect-for-seniors/

References:

Protective

Ihlic

https://finalexpenseinsurance.com/why-final-expense-insurance-is-perfect-for-seniors/ Categories: Final Expense Life Insurance

3 Comments

New Concepts For Living offers Group Homes for Adults With Developmental Disabilities in Bergen County NJ. For Supervised Housing for Special Needs Adults in Bergen County NJ Contact NCFL.