Final expense life insurance is a permanent life insurance (Whole Life insurance) designed to guarantee your loved ones they won’t be left with any struggles at the moment of your death. This type of policy will provide the funds to cover your end of life issues such as pending medical bills, debts, your desired funeral, and other expenses you may leave behind when you pass away.

HOW MUCH DOES A FUNERAL COST?

Everything has increased in price! Well it’s the same for funerals. The average cost of funeral expenses has increased at least 2.5 times more than it was 30 years ago. Simply, a funeral in 1986 had a cost between $3,000 and $5,000 and nowadays it has a cost of approximately $12,500. This is something to be afraid of, isn’t it? The worse thing is that prices will continue to increase.

If the prices keep increasing at the same rate as they have been, if a funeral costs around $11,000 today in 2020, wich is a roughly average, and continues to increase, then by 2040 will approximately cost $22,000 (and we are talking about a traditional funeral).

The same thing with cremation. A cremation that has a cost of $4,500 today, wich is about average, will double its price to about $9,000.

This is why it is very important to be prepared with enough coverage and acquire a final expense policy.

Now, beyond covering end of life expenses, there are other reasons to have enough coverage, for example to cover medical bills and other left behind debts.

2020 FUNERAL COST IN CALIFORNIA

Types of funeral services

Cremation services

Shipping services

Final expense Insurance - The basics.

Funeral coverage is not the same as insuring your life. Final expenses coverage is nothing more than covering everything related to your death. It is not like other policies in which you leave the future of your loved ones assured, but a support that they will need at the time of your departure, so they wont have to put any money out of their own pocket or have to go further into debt to cover your funeral expenses.

How does Final expense Insurance work?

Final expense is the best way to leave your loved ones without any concerns or expenses they may not be able to cover. How does final expense work? Well it’s a very easy procedure, let me explain.

We all know our current situation, so of course we can find a coverage that meets our needs, that is why it is as simple as to answer a few basic health questions, nothing too specific, but enough to determine which program would be the best for you. Basic questions such as:

⦁ What is your date of birth?

⦁ What is your height and weight?

⦁ Have you smoked in any way in the past 12 months? What kind of cigar?

⦁ Do you have any lung, kidney or liver problems? Is there any COPD, emphysema use of oxygen, hepatitis o dialysis?

⦁ Any kind of diabetes Pills or insulin? Any diabetic complications?

⦁ Is there any heart problem history? Any heart attacks, strokes, seizures, shunts, stents (coronary artery stents), pacemaker? Do you take nitroglycerin?

⦁ Have you been hospitalized in the past 12 months overnight for any reason?

⦁ Is there any cancer?

⦁ Is there any depression, bipolarity, schizophrenia, dementia, alzheimer? Any neurological problems like lupus or Parkinson’s?

If you are taking any medications it will be neccessary to have the list of everything you are taking.

Everyone wants a life insurance, but they also want something they can pay for, because what’s the point of having a policy that the payments are too high, and you will end up cancelling in 6 months? The true thing is that the best policy you have, is the one that is active when one dies.The one you can pay comfortably. This is why you will be given different options with different coverage amounts and monthly premiums and give you the opportunity to choose the one that most adjusts to your budget.

After choosing the plan of your interest, you will just need to give out your personal information, choose your beneficiary and paying method, once your first premium is charged, you’re all covered and ready to enjoy your benefits!

It’s such an easy and adjustable way to acquire your Final expense Insurance that you don’t need to wait until the last moment for your loved ones to struggle because you didn’t prevent your death, just like what happened to Melissa. (This is a real life case).

WHAT WERE MELISSA’S THOUGHTS THE

MOMENT HER HUSBAND RAÚL DIED?

“AND NOW, WHAT AM I GOING TO DO?”

“HOW AM I GOING TO PAY FOR THE FUNERAL?”

“HOW AM I GOING TO SUPPORT MY CHILDREN?”

On July 19, 2020, Melissa was with her husband Raúl in the hospital, who suffered from heart failure. Melissa left for a moment to get something to eat for herself, and upon returning what was her surprise, her husband had already passed away. Sadly, Raúl never liked talking about death or the possibility of acquiring some type of coverage for when that day arrived and leaving his family protected. Raúl had nothing.

Melissa being a housewife and mother of two minors would be the one to pay for the consequences of Raúl’s mistake, of not having acquired a final expense coverage.

Melissa had no way to pay the pending medical bills, the funeral of her late husband, and sadly she no longer had money to support her family, she had to go into debt with a large amount of money only for Raúl’s funeral wich, even being one of the ,ost simple and traditional, would leave her without a penny for her and her family.

Fortunately, Melissa had some very good neighbors who supported her with what they could to cover the expenses, as well as with food and essential utensils for raising a family. As Melissa all her life, was a housewife and took care of her two minors, now she will have to battle for a while to recover her economic stability and separate for a time from her children, due to the fact that Raúl left them homeless and with the funerals debt.

Now Melissa, since she went through all this, is willing to acquire her final expense coverage that best suits her needs so that when the least expected day arrives, her children will not have to go through the same thing again.

* WHAT WOULD YOU DO IN MELISSA’S CASE?

We at thescplan.com can help you.

Benefits of Final expense Insurance.

Final expense offers 5 main benefits not all policies give you.

1. First, your coverage begins since day 1, 100% coverage. You are fully covered when the program begins without the 2- year waiting period.

2. Second, your coverage is never canceled due to age or health. Just pay the premiums and you are always covered.

3. Third, your price is guaranteed to never increase. You will always pay the same premium each month without having to go through increases.

4. Forth, you choose the beneficiary you want.

5. And last but not least, fifth, the money you receive will be tax free.

We all know that planning a funeral is not easy and quick. This particular task requires a lot of patience and it might get complicated throughout the way because some feelings might be involved after your loved one passed away. This last minute plans will be hit by sentiments and emotions and whoever gets the task of planning your last minute funeral won’t even have the head to do it. This is why we should take advantage of the benefits final expense insurance offers and not make family and friends go to through the complications of planning the funeral. Of course, it won’t be easy to plan your own funeral, but the results will speak for themselves.

Difference between Term Life and Final Expense (Whole Life)

The truth is that not all policies are the same. Some programs are better than others, and you should know all the differences before making a decision on the right program for you.

Term life insurance is a policy that guarantees the death benefit payment to the insured’s beneficiary, but only if he/she dies in a specific term. A simple way to remember how term works is that Term, Terminates, so when this happens what you can do is renew it for another term, convert the policy into permanent or just wait until it terminates. This type of policies have no other value than the guaranteed death benefit and feature no savings component as in a Whole Life policy. f you die during the term of the policy, the insurer will pay the face value of the policy to your beneficiaries. This cash benefit—which is, in most cases, not taxable—may be used by beneficiaries to settle your healthcare and funeral costs, consumer debt.. However, if the policy expires before your death, there is no payout.

Whole life insurance policy however, just like it’s name says, is for the whole life. These type of policies cover you until age 120. You don’t need to worry for it to expire, renew or anything, you aquire your policy and as long as you are paying your premiums, you are covered. The death benefit is given to the beneficiary when you pass away and they can cover all the expenses you left behind such as medical bills, funeral expenses, etc.

Now that you know the difference, I think we are on the same page that Final Expense is a better way.

What is not Final expense.

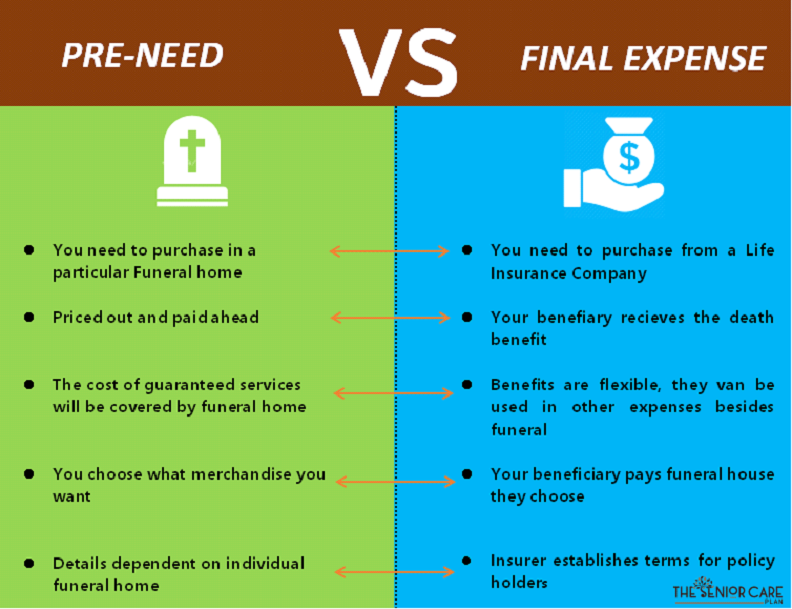

A pre-need plan is purchased from a particular funeral home. To acquire it, you choose the funeral home you most desire to work with and specify the arrangements you want when the day comes. After you have specified all your desires, the funeral home gives you prices and gives you the option to pay the cost ahead of time either all at once or over time. THIS IS NOT THE SAME AS FINAL EXPENSE!

Most people confuses a pre-need plan with final expense thinking they have the same type of procedure and arrangements, but there is a difference between these. Final expense offers what a pre-need plan doesn’t, such as more flexibility, that their policies are not dependent on funeral homes and that not all final expense policies are the same.

Types of Final expense Insurance.

Types of final expense insurance

There are two types of final expense life insurance: guaranteed issue life insurance or simplified issue life insurance.

Guaranteed issue life insurance

Guaranteed issue policies ask just a few knockout questions to make sure you don’t currently have a terminal illness but otherwise will cover high-risk individuals. Because of this, it’s more expensive than SIMPLIFIED WHOLE LIFE and offers lower maximum coverage amounts, typically at or below $25,000.

Simplified issue life insurance

Simplified issue life insurance is a type of whole life insurance that is good for people who may not qualify for a fully underwritten life insurance policy but are only considered moderate risk. You’ll have to answer a detailed medical questionnaire, but there’s no medical exam involved. This is your best bet for getting an affordable life insurance policy with coverage up to $50,000.

1 Comment