Today’s consumers want fast and easy options to protect their families from unexpected financial burdens, especially final expense. There are many types of final expense insurance plans. Final expense plans can genuinely help your loved ones by taking away the financial burdens the family will feel upon your death.

What Are The Types Of Final Expense Insurance?

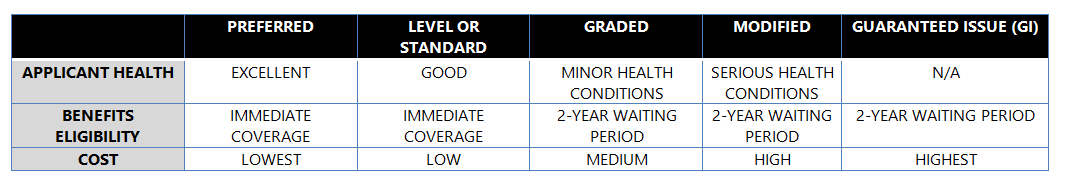

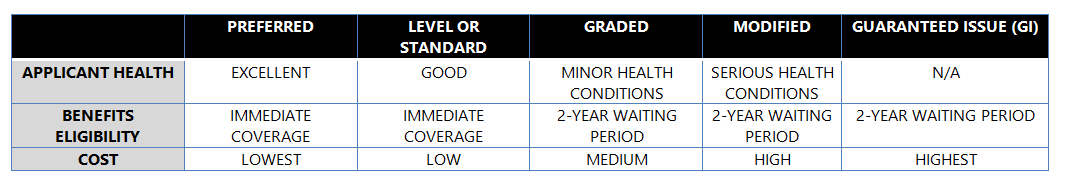

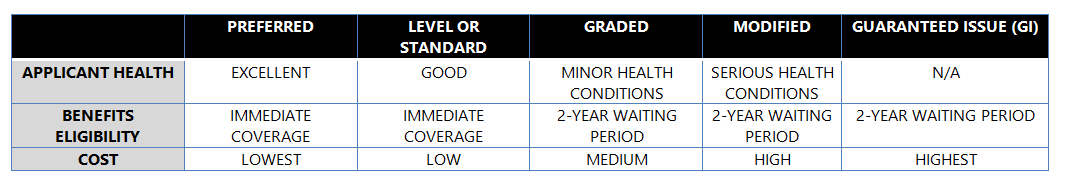

Before we go deeper into each topic, let’s take a look at what makes them different:

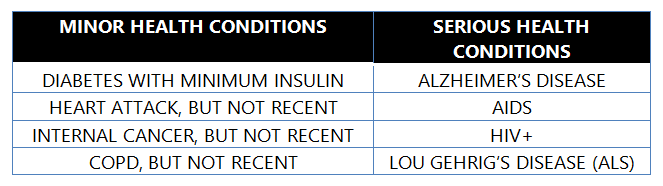

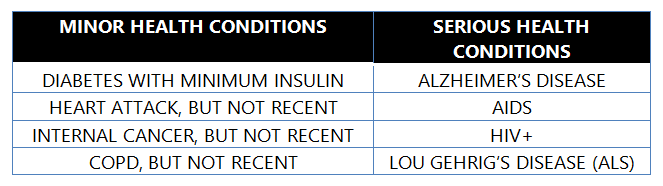

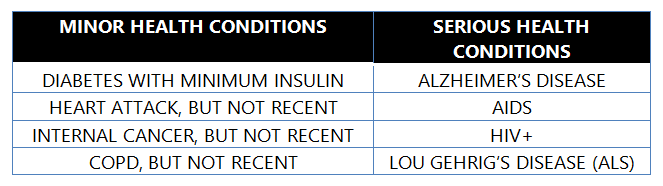

These are some examples of

“Minor” health conditions and

“Serious” health conditions. They can vary depending on the carrier, but here is a sample to give you an idea:

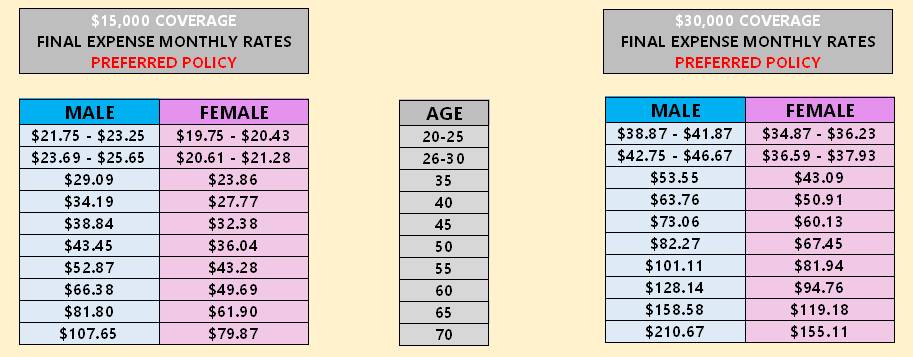

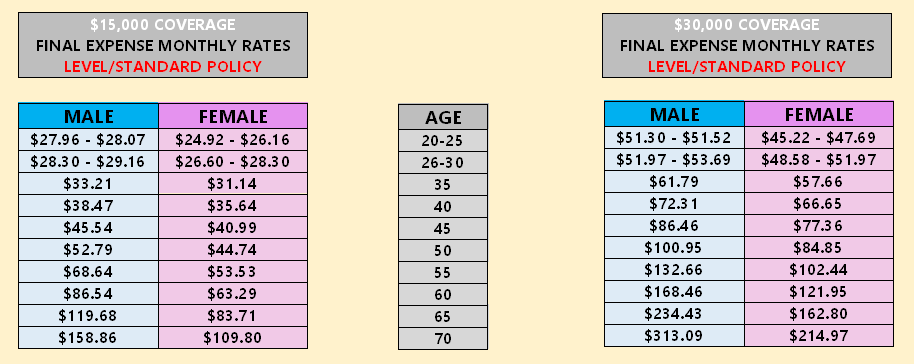

Since final expense insurance is a form of life insurance, as a client make sure to know that there can’t be any rate increases. Once you lock in your rate, that rate won’t change. The only way the rate can go up is with age, the sooner you acquire your policy, the better. For example, if you obtain your coverage at age 40 and your monthly premium is only $32.99 you will pay the same rate for the life of the policy. The older you get, the more the rates go up.

Final expense benefits are tax-deferred

Final expense benefits are tax-deferred

It is also important to understand that final expense benefits are tax-deferred. Your beneficiary is not required (according to current tax law) to pay any taxes on the received death benefit.

According to Preciado funeral home in 923 W. Mill Street, San Bernardino CA 92410 a traditional service currently in August 2020 includes:

- Casket….. $6,595

- Flowers (Casket and floor arrangements)….. $1,145

- Book & memorial folder….. $175

- Transportation to funeral home….. $600

- Viewing transportation to the cemetery….. $2,146

- Chapel rental….. $2,096

- Embalming… $800

- Dressing and cosmetology….. $250

Which gives us a total of

$13,807

- Currently, in August 2020, a plot in Mt. View Cemetery in San Bernardino, California has a cost of approximately $8000.

Now that’s the most important part that needs to be covered, but now let’s consider other costs:

- Catering….. $2000

- Music….. $150

- Funeral keepsakes…..$300

- Transporting family, friends, etc… $500

- Personal touches….. $ 500

Which gives us a total of

$3,450.

- Other expenses (medical bills, left behind debts, etc)….. $4,743

Considering this is are the costs for a traditional funeral, the ideal coverage would be a

$30,000 policy.

Let’s now take a deeper look at the options you have when it comes to final expense policies.

PREFERRED

| APPLICANT HEALTH: |

EXCELLENT |

| BENEFITS ELIGIBILITY: |

IMMEDIATE COVERAGE |

| COST: |

LOWEST |

Preferred policies are given to applicants in excellent health conditions. You must say no to every health question asked in the final expense application to qualify for this type of policy. Furthermore, your MIB file and prescription history must no reveal any treatments or medications for any conditions, you must have the ideal height and weight.

This kind of policy offers the full death benefit immediately after death occurs. This type of final expense policy will immediately and fully cover you.

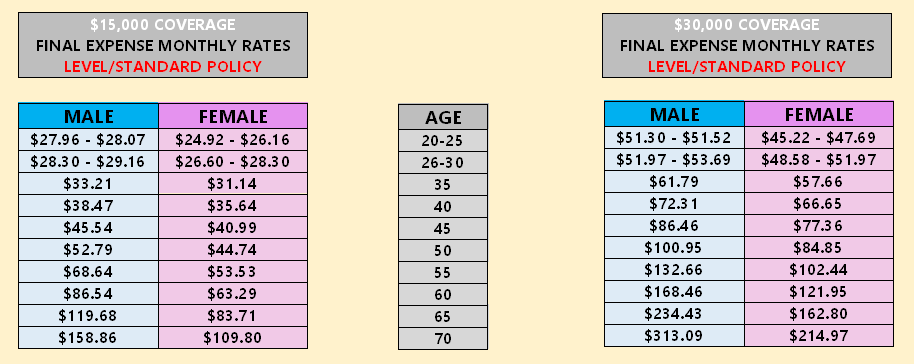

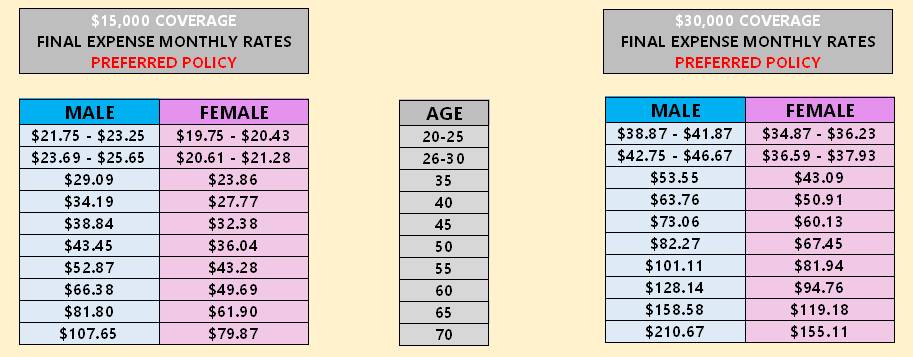

Monthly rates for a preferred policy.

LEVEL OR STANDARD

| APPLICANT HEALTH: |

GOOD |

| BENEFITS ELIGIBILITY: |

IMMEDIATE COVERAGE |

| COST: |

LOWEST |

Level policies or also known as standard policies are given to applicants with good health. If in the past you’ve had any surgical procedures, you are on any prescriptions or you have health conditions, check with the carrier of your choice to see if they might pass through underwriting. For some carriers, some of these complications are considered good health and you can apply for a level product, for other carriers you might be considered for a graded or modified policy. It can vary depending on the carrier.

This kind of policy offers the full death benefit immediately after death occurs. This is also another type of final expense policy that will immediately and fully cover you.

The premiums for this type of policy are a little higher than preferred but still lower than graded, modified and guaranteed issue.

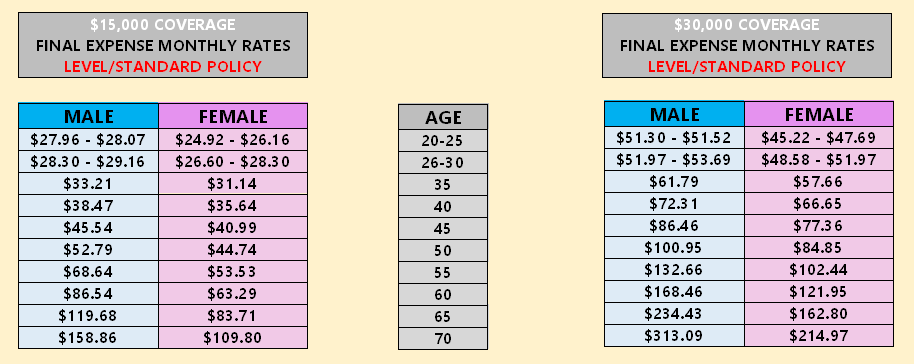

Monthly rates for a level/ standard policy.

GRADED

GRADED

| APPLICANT HEALTH: |

MINOR HEALTH CONDITIONS |

| BENEFITS ELIGIBILITY: |

2-YEAR WAITING PERIOD |

| COST: |

MEDIUM |

Health conditions vary depending on the carrier, but as an example, having Parkinson’s, systemic lupus, liver disease, or COPD might place you in a graded plan.

Graded policy benefits usually have a 2-year waiting period before the entire death benefit can be paid to a beneficiary or beneficiaries. While this is usually the case, you need to cross-check this with your carrier of your choice. If non-accidental death occurs before two years, the policy will only pay a percentage of the death benefit.

For example:

- If a death happens in year one, perhaps only 30% of the death benefit will be paid.

- If non-accidental death occurs in year two, 70% of the death benefit will be paid.

- Death in year three or later will pay 100% of the death benefit.

In case you were wondering, here are some examples of “accidental death”:

- Car accident

- Falls

- Poisoning

- Drowning

- Fire-related death

- Suffocation

- Firearms (excludes acts of war and suicide)

- Industrial accidents

- General accidents (medical professional mistakes, falling objects, air transport injury, etc.)

“Non-accidental deaths” include:

- Illnesses

- Old age

- Suicide

Monthly rates for a graded policy.

MODIFIED

MODIFIED

| APPLICANT HEALTH: |

SERIOUS HEALTH CONDITIONS |

| BENEFITS ELIGIBILITY: |

A 2-YEAR WAITING PERIOD |

| COST: |

HIGH |

Like graded policies, carriers have health conditions that would place you into a Modified plan, such as alcoholism, angina, stroke, aneurysm, or cancer.

Modified policy benefits usually have a 2-year waiting period just like graded policies, before the entire death benefit is paid to a beneficiary. If non-accidental death occurs before two years, the policy will only pay a return of premiums plus a percentage.

For example:

- If death (non-accidental) happens in year one, the premiums will be returned plus 10% will be paid.

- If non-accidental death occurs in year two, premiums paid are returned plus 20%.

- Death in year three or later will pay 100% of the death benefit.

Monthly rates for a modified policy.

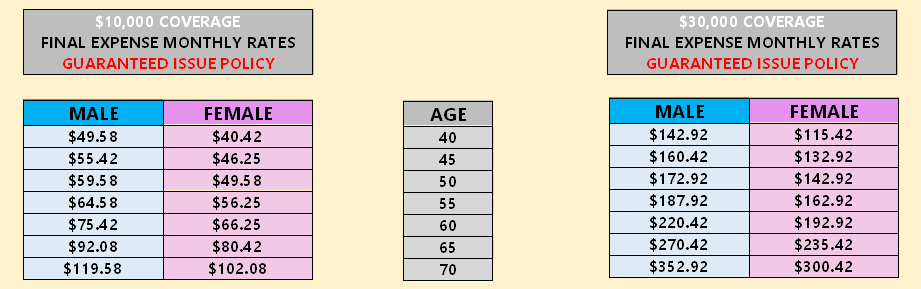

GUARANTEED ISSUE (GI)

GUARANTEED ISSUE (GI)

| APPLICANT HEALTH: |

N/A |

| BENEFITS ELIGIBILITY: |

WAITING PERIOD = 2 YEARS |

| COST: |

HIGHEST |

Guaranteed issue policy benefits are very similar to a modified policy, but more expensive since there are no health questions necessary. With guaranteed issue there is no chance of getting declined since there is no health underwriting. This is why guaranteed issue policy costs are the highest of all types of final expense policies.

The guaranteed issue has a 2-year waiting period before the entire death benefit can be paid to a beneficiary or beneficiaries. If death (non-accidental) occurs before two years, the policy will only pay a return of premiums plus a percentage.

For example:

- If non-accidental death happens in year one, all premiums paid will be returned plus 20%.

- If non-accidental death occurs in year two, all premiums paid are returned plus 20%.

- Death in year three or later will pay the full benefit.

The conditions and percentages shown above are only examples, and they vary by carrier and plan. But with most insurance products, the healthiest clients pay the lowest rates.

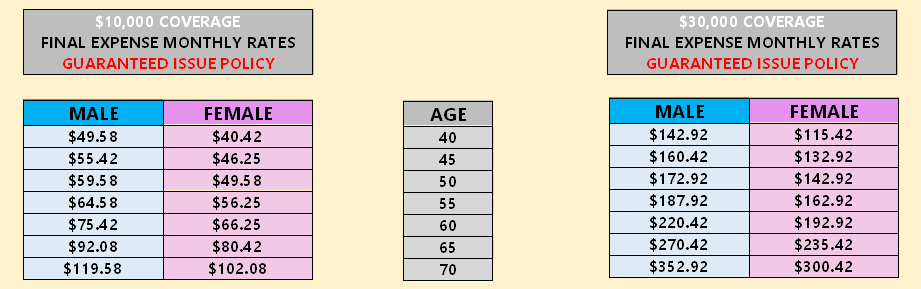

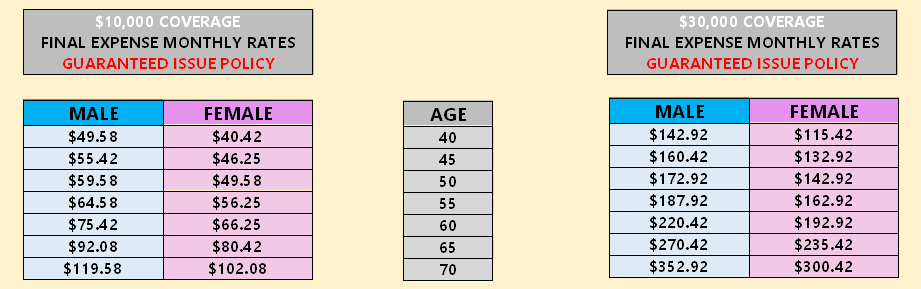

Monthly rates for a guaranteed issue policy

These are some of the types of final expense insurance, if you know any other types of final expense insurance policies, let us know in the replies below.

These are some examples of “Minor” health conditions and “Serious” health conditions. They can vary depending on the carrier, but here is a sample to give you an idea:

These are some examples of “Minor” health conditions and “Serious” health conditions. They can vary depending on the carrier, but here is a sample to give you an idea:

Since final expense insurance is a form of life insurance, as a client make sure to know that there can’t be any rate increases. Once you lock in your rate, that rate won’t change. The only way the rate can go up is with age, the sooner you acquire your policy, the better. For example, if you obtain your coverage at age 40 and your monthly premium is only $32.99 you will pay the same rate for the life of the policy. The older you get, the more the rates go up.

Since final expense insurance is a form of life insurance, as a client make sure to know that there can’t be any rate increases. Once you lock in your rate, that rate won’t change. The only way the rate can go up is with age, the sooner you acquire your policy, the better. For example, if you obtain your coverage at age 40 and your monthly premium is only $32.99 you will pay the same rate for the life of the policy. The older you get, the more the rates go up.

Final expense benefits are tax-deferred

It is also important to understand that final expense benefits are tax-deferred. Your beneficiary is not required (according to current tax law) to pay any taxes on the received death benefit.

According to Preciado funeral home in 923 W. Mill Street, San Bernardino CA 92410 a traditional service currently in August 2020 includes:

Final expense benefits are tax-deferred

It is also important to understand that final expense benefits are tax-deferred. Your beneficiary is not required (according to current tax law) to pay any taxes on the received death benefit.

According to Preciado funeral home in 923 W. Mill Street, San Bernardino CA 92410 a traditional service currently in August 2020 includes:

GRADED

GRADED

MODIFIED

MODIFIED

GUARANTEED ISSUE (GI)

GUARANTEED ISSUE (GI)

These are some of the types of final expense insurance, if you know any other types of final expense insurance policies, let us know in the replies below.

These are some of the types of final expense insurance, if you know any other types of final expense insurance policies, let us know in the replies below.  These are some examples of “Minor” health conditions and “Serious” health conditions. They can vary depending on the carrier, but here is a sample to give you an idea:

These are some examples of “Minor” health conditions and “Serious” health conditions. They can vary depending on the carrier, but here is a sample to give you an idea:

Since final expense insurance is a form of life insurance, as a client make sure to know that there can’t be any rate increases. Once you lock in your rate, that rate won’t change. The only way the rate can go up is with age, the sooner you acquire your policy, the better. For example, if you obtain your coverage at age 40 and your monthly premium is only $32.99 you will pay the same rate for the life of the policy. The older you get, the more the rates go up.

Since final expense insurance is a form of life insurance, as a client make sure to know that there can’t be any rate increases. Once you lock in your rate, that rate won’t change. The only way the rate can go up is with age, the sooner you acquire your policy, the better. For example, if you obtain your coverage at age 40 and your monthly premium is only $32.99 you will pay the same rate for the life of the policy. The older you get, the more the rates go up.

Final expense benefits are tax-deferred

It is also important to understand that final expense benefits are tax-deferred. Your beneficiary is not required (according to current tax law) to pay any taxes on the received death benefit.

According to Preciado funeral home in 923 W. Mill Street, San Bernardino CA 92410 a traditional service currently in August 2020 includes:

Final expense benefits are tax-deferred

It is also important to understand that final expense benefits are tax-deferred. Your beneficiary is not required (according to current tax law) to pay any taxes on the received death benefit.

According to Preciado funeral home in 923 W. Mill Street, San Bernardino CA 92410 a traditional service currently in August 2020 includes:

GRADED

GRADED

MODIFIED

MODIFIED

GUARANTEED ISSUE (GI)

GUARANTEED ISSUE (GI)

These are some of the types of final expense insurance, if you know any other types of final expense insurance policies, let us know in the replies below.

These are some of the types of final expense insurance, if you know any other types of final expense insurance policies, let us know in the replies below.

2 Comments