Planning a funeral with final expense insurance requires careful consideration of all your final needs. Consider how you want your loved ones to remember you? Where you want your final resting place to be? Whether you wish to be buried or cremated, and what type of casket or urn you prefer. All these little details are what will make your funeral the moment when all your loved ones will remember you as you wanted. Considering all this, you might ask, how much final expense coverage should I buy?

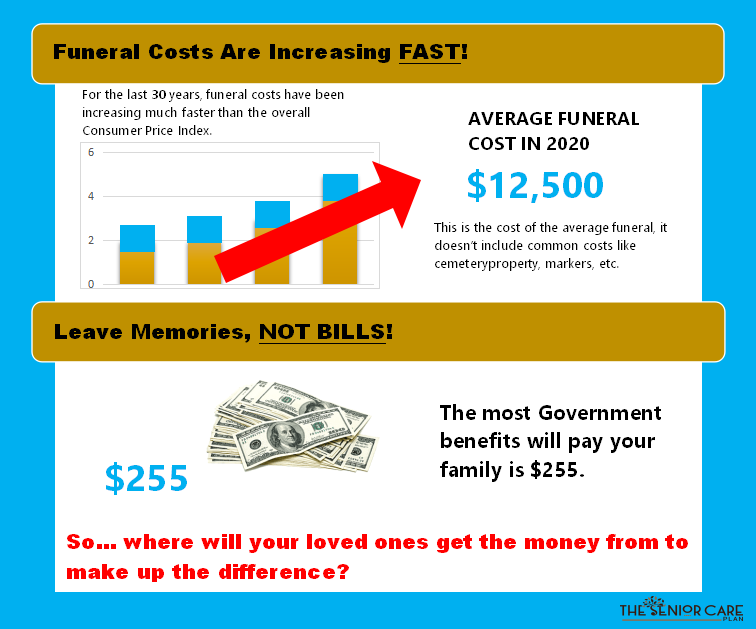

The average funeral costs between $7,000 and $12,500 nowadays. The benefit amount paid out from Social Security at the time of passing is only $255. Even if you look forward to less expensive options such as a cremation the costs can still run as high as $3,500 with all the related costs to the funeral (service, memorial, etc.), not to mention flowers, an urn, or any other miscellaneous costs. As you can see there is a huge discrepancy in the amount you would need for a funeral versus what you might have thought.

Final Expense Coverage

It’s well known that a traditional full-service funeral, including a viewing, a hearse, a formal ceremony, or entombment has a higher cost than a direct burial or cremation. When you consider the costs of your funeral, you must take every extra expense into account in order to arrive at an accurate estimate of your financial needs will be ensuring you have enough final expense coverage.

It’s important to know the costs of a cemetery plot, a headstone and flowers must also be paid for separately. And a procession, limousines, flowers, and awake can also be included.

Funeral planning costs a considerable amount of money and the Social Security Administration isn’t going to cover the costs. It’s important you determine which type of funeral you wish to plan for. Ensure you accurately describe it with your will or your beneficiary/ beneficiaries for carrying out your wishes. Taking the time to prepare for end-of-life expenses will ensure you protect your legacy. And therefore, your loved ones don’t have to worry about going into debt to memorialize you.

To determine how much final expense coverage you will require, you first need to try and estimate your total final expenses, which is a simple process with only 3 steps:

1. ESTIMATE HOUSEHOLD EXPENSES.

Family expenses are estimated by taking the total amount of a typical month’s expenses. This includes house payments, utilities, car expenses, food and transportation costs, insurance fees, etc.) and multiplying by 3. This will roughly be the amount your family needs to survive for 3 months. So if your total monthly expenses are $2,500, then your number for family expenses will be $7,500. ($2,500 x 3 = $7,500.)

2. FACTOR IN FUNERAL EXPENSES.

Funeral expenses are determined by what kind of funeral you desire and end up choosing. In addition, you need to think about; service, casket, flowers, transportation, viewing, etc. And from what we know the average funeral has a cost of around $12,500. For now, let’s say your funeral expenses will be the average $12,500 plus the average $10,000 for any extra expenses and left behind debts.

3. ADD TO FIND TOTAL FINAL EXPENSES.

In order, to get your total final expenses, add the above figures together, which in this case are $7,500 for family expenses, $12,500 for funeral expenses, and $10,000 for extra expenses and left behind debts. This amount, $30,000, would be the minimum coverage you will require to account for both funeral and family expenses.

References: