We at thescplan.com have created this simple and basic guide with the purpose of helping you understand the procedure of applying for final expense insurance policy. Applying for final expense insurance is relatively standard depending on the type of insurance and the carrier you choose.

Final expense insurance carriers offer level policies with no medical exam and will only require you to answer a few basic health questions. Other carriers offer guaranteed issue policies with no medical exam neither health questions, but let’s keep in mind the cost might be higher than a policy that requires health questions.

Whatever policy you end up choosing, it is very important that you have all your personal information handy ready for applying for a final expense policy.

In general, applying for final expense insurance application is very similar to any type of life insurance application process. You will need to provide some basic personal information such as your name, age, date of birth, and address, sometimes answer a few questions regarding your recent medical history.

Process of Applying For Final Expense Insurance

To start your application process there are 6 simple steps to follow and start enjoying the benefits final expense insurance offers:

1: Get Your Free Quote.

2: Choose Wich Policy Is The Most Affordable For You.

3: Fill Out The Application Form.

4: Phone Interview.

5: Wait For Underwriting.

6: Accept Your Offer And receive Your Policy.

Step 1: GET YOUR FREE QUOTE.

The final expense insurance application process begins by obtaining your free life insurance policy quotes online.

Getting a quote has never been easier! First, go to thescplan.com website, it can provide you a quote from many different carriers. Working with The senior care plan agency will save yourself the hassle of getting a quote from each carrier individually.

Getting your free quote will help you know how much does final expense insurance costs.

A Senior care plan professional can walk you through every step of the way. There is no cost for this service and the advice will be extremely valuable.

Your senior care plan agent will assess what type of policy is best for you and what cost to expect on your new policy. If you have any health conditions, your agent will pre-screen these conditions and recommend carriers that are friendly with your health issues.

Compare rates

Make sure to do your shopping with all the best carriers in the market. Compare rates with different carriers to avoid overpaying for coverage. Comparison shopping will ensure you get the best rate.

Use our FEX quoting engine to check out the rates and insurers available to you. Just fill out the quote form with a few pieces of information:

- Your name – your full name.

- State of residence – rates may vary by state because states regulate life insurance carriers.

- Birthday – insurance rates vary by age.

- Gender – insurance rates vary for men and women.

- Smoker/Tobacco – insurers want to know if are currently using tobacco or you have done so in the past.

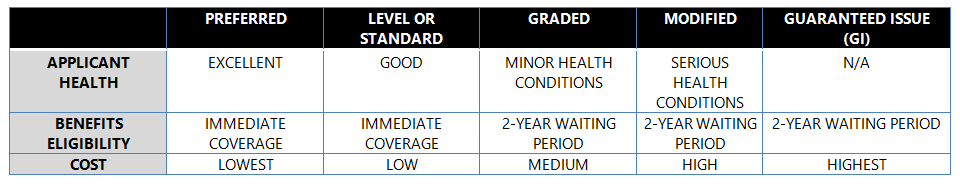

- Health class (Benefit type) – your health class will vary depending on if you have excellent, decent or poor health.

- Coverage amount you want – select from $2,000 to $100,000.

Once you input your information in our free quote form, click “submit” and you will see a list of quotes, sorted by the lowest price. You will see the lowest rate at the top of the list.

THE SENIOR CARE PLAN will never sell your information or use it for anything except give you the most affordable final expense life insurance quotes.

Step 2: Choose Which Policy Is The Most Affordable For You

The second step to the application process is to choose what type of final expense insurance you need. If you are like most senior citizens, you are most like be looking for a simple final expense insurance policy to cover the cost of a funeral. This way your family won’t be left with a financial burden after your pass away.

Types of Final Expense Insurance

As long as the policy is available in your state and you fall on the age brackets the company is guaranteed to offer you a policy.

If you have a pre-existing health condition that makes it impossible to qualify for traditional life insurance, you should consider a guaranteed issue policy. GI policy comes with a graded death benefit or two-year waiting period.

Features of Final Expense Insurance:

- Permanent whole life policy

- Level premium – premiums never increase

- Benefits never decrease for any reason

- Available for seniors ages 50 to 85 (some carriers accept from age 18)

- Minimal face amount $2,000 up to $100,000

- No medical exam required

- The policy accumulates cash value

Once you decided which type of policy you want and received the pricing form the instant quote tool, the next step is deciding which carrier to apply.

You need to consider the company with the best price. Another thing you may need to consider is the financial stability of the carrier.

The senior care plan only works with “A” rated or better insurance carriers. It is important to make sure that the company is stable and has the ability to pay its policyholders on time.

Step 3: Fill Out An Application Form

After you have found the insurance company that’s the perfect fit for your needs, it’s time to apply.

Completing an application will be the next simple step after you have found an agent and the type of policy that best fits your budget. This application can be in paper form, a telephone application, or online application.

Things to prepare before the application:

- Your social security number

- Driver’s license number

- Beneficiary information

- Contingent beneficiary information (needed in case the insured and the primary beneficiary died at the same time)

- Your doctor’s contact information

The application process will typically take 10 to 20 minutes.

Types of Questions asked

There will be a series of questions to answer from personal information to medical history to the type of lifestyle you live. First is your basic information name, age, birthday, and address.

You will be asked about your:

- Health history

- Family health history

- Prescription medications

- Any dangerous hobbies and activities

- Driving record

- Criminal record

They will be ask about your social security number and driver’s license number. The life insurance company needs this information so that they can access your driving records and medical history.

Your medical and family history will also be asked. The insurer needs to know your health risk to accurately determine what premium you will be paying for your policy.

When filling out your application, supply your beneficiary or the person who will receive the cash benefit if you pass away.

It is wise to supply contingent beneficiary information in case something happens to your primary beneficiary and the policy owner at the same time (for example – husband and wife both die in an automobile accident together).

When the application is completed, we will need your signature. Many insurance carriers do this digitally. We sometimes will email you a copy of the completed application form for you to sign.

The insurance carriers who require a paper application will mail you the application to your physical mail, with the places for your signature clearly marked. When you’re finished, just put the application form into the postage-paid envelope provided and drop it in the mail.

Be honest when filling out your application. Don’t lie or give false information. Its fraud and the company will most likely find out and deny your death claim.

Step 4: Phone Interview for final expense insurance

Only the preferred level policies undergo an underwriting process. Guaranteed issue policies skip this step.

If you choose a level policy, you will likely receive a telephone interview with the insurance company’s underwriting staff to clarify some of the questions you answered on your application.

You must answer honestly and do not give information they never ask about.

You will need to answer about your:

- Health history

- Lifestyle

- Family health history

- Dangerous hobbies and activities

It is best to answer truthfully as possible to ensure you are getting the best policy for your needs.

The information that will be asked in the follow-up underwriting phone call will be:

- Social Security Number – the social security numbers is a requirement on all applicants. This number act as your unique identifier.

- Driver’s license – your driver’s license number because your driving history may be part of the underwriting process.

- Prescription medication – this information will be asked during the phone interview. However, prescription history is always double-checked.

- Checking account number – this is necessary to choose the drafting day for your payment

- Beneficiary information – supply the name and birthdate of your primary beneficiary and a contingent beneficiary.

Policies are often approved on the telephone interview with the applicant still on the phone.

Policies can take between 24-48 hours to get approved.

Step 5: Wait For Underwriting

This is the easiest step, and there’s nothing you need to do except wait for your approval!

Your insurance carrier is doing all the work in this step. It is the part of the process where the insurance company reviews your application, access your personal and medical information history from the MIB to assess your level of risk, and figure out if you qualify and at what cost.

Underwriters will look into:

Your driving record

The underwriting department may run a routine motor vehicle report to see if you have driving violations than indicates unsafe driving habits which could increase your chance of having fatal highway accidents.

The primary violations to look for would be drag racing, driving under the influence of alcohol or drugs, reckless driving, and speeding violations.

Parents’ health history

They will ask you some basic questions regarding your parents’ health history. The underwriters may ask if your parents are still alive. They would like to know if you have a gene-related illness such as cancer or heart disease that could be passed down to you.

Prescription drugs

Underwriters will run a check on prescription drugs that you take and what are the uses of the drugs. A computer database shows your pharmacy purchases. The insurance carrier will see your history of drug purchases and for what purposes.

Underwriting timelines can vary depending on the insurance company and the caseload of the underwriter assigned to your case.

Step 6: Accept Your Offer And Receive Your Final Expense Insurance Policy

Congratulations! You have an answer!

As soon as the carrier makes a decision about your application and you will be offer a rate. After that they will be in touch with you by phone or email.

If their offer is different from the rate you got in your original quote, we will work with you to determine your best options. It is very common to be offered different rates by different insurance carriers, even when those carriers are looking at the exact same information.

Now that you’re approved for coverage, review the plan and if you’re happy with it. You will receive your policy in the mail or online after a few days.

Sign all applicable documents and pay your first premium. You have the option to make monthly, quarterly, semi-annually, or annual payments. If you have the budget, pay annually, and save more money.

Pay your first premium when you apply to activate the policy instantly.

You will have a 30-day free look back period to review the policy. If there are things that you don’t like, you can change it or get your money back. So whether you paid monthly or annually, you can get your refund.

Applying for final expense insurance is easy when you have an experienced life insurance agent from The senior care plan to assist you.

Reference: